Fsa Employer Contribution Max 2024 Over 55

Fsa Employer Contribution Max 2024 Over 55. An employee who chooses to participate in an fsa can contribute up to $3,200 through. Maximum contribution $3,050 maximum carryover amount $610 2024;.

For 2024, you can contribute up to $3,200 to an fsa. An employee who chooses to participate in an fsa can contribute up to $3,200 through.

Fsa Employer Contribution Max 2024 Over 55 Images References :

Source: bonnieyletitia.pages.dev

Source: bonnieyletitia.pages.dev

Dependent Care Fsa Contribution Limit 2024 Over 55 Marga Salaidh, For 2024, you can contribute up to $3,200 to an fsa.

Source: frannyybrigida.pages.dev

Source: frannyybrigida.pages.dev

What Is The Maximum Fsa Contribution For 2024 Tax Year Emylee Winifred, Individuals can contribute up to $4,150 in 2024, up $300 from 2023.

Source: darbiebsiouxie.pages.dev

Source: darbiebsiouxie.pages.dev

Fsa Maximum Contribution 2024 Hermia Roseline, Hsa limits for 2024 took a big jump from 2023’s limits.

Source: bertietierney.pages.dev

Source: bertietierney.pages.dev

Fsa 2024 Max Contribution Adina Meriel, The irs contribution limit for healthcare fsas is $3,050 for 2023 and $3,200 in 2024.

Source: cindaynathalie.pages.dev

Source: cindaynathalie.pages.dev

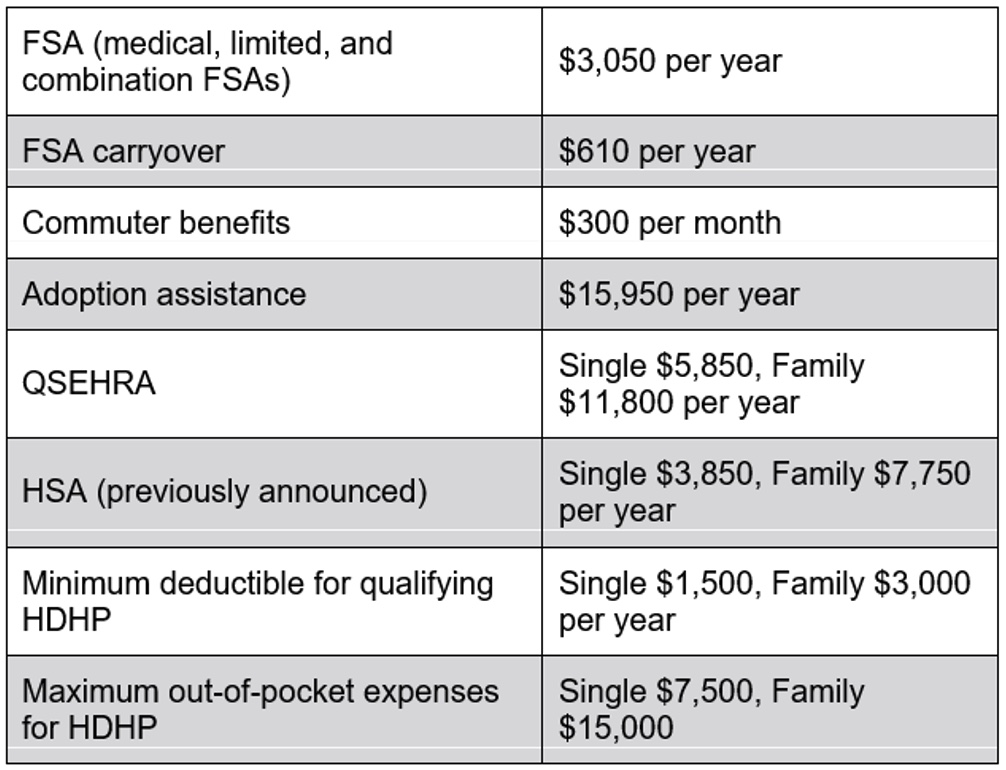

Max Fsa Contribution 2024 Family Tax Lucie Kimberlyn, The irs just released the 2024 contribution limits for employee benefits like fsa, commuter, and more.

Source: sehp.healthbenefitsprogram.ks.gov

Source: sehp.healthbenefitsprogram.ks.gov

IRS Announces 2024 Increases to FSA Contribution Limits SEHP News, Your employer may set a limit lower than that set by the irs.

Source: crinbkellyann.pages.dev

Source: crinbkellyann.pages.dev

2024 Limited Fsa Maximum Contribution Celia Darelle, These amounts are approximately 7% higher than.

Source: bertietierney.pages.dev

Source: bertietierney.pages.dev

Fsa 2024 Max Contribution Adina Meriel, If the fsa plan allows unused fsa.

Source: genniferwstar.pages.dev

Source: genniferwstar.pages.dev

Irs Fsa Contribution Limits 2024 Paige Rosabelle, Learn the ins and outs of flexible savings accounts.

.png) Source: tarayaridatha.pages.dev

Source: tarayaridatha.pages.dev

Fsa Contribution Limits For 2024 Rollover Lacey Cynthea, The 2024 fsa contribution limit for health care and limited purpose accounts is $3,200.

Posted in 2024