Alabama Income Tax Rate 2025

Alabama Income Tax Rate 2025. The alabama tax estimator lets you calculate your state taxes for the tax year. Compare your take home after tax an.

This tool is freely available and is designed to help you. The alabama tax estimator lets you calculate your state taxes for the tax year.

Alabama Income Tax Rate 2025 Images References :

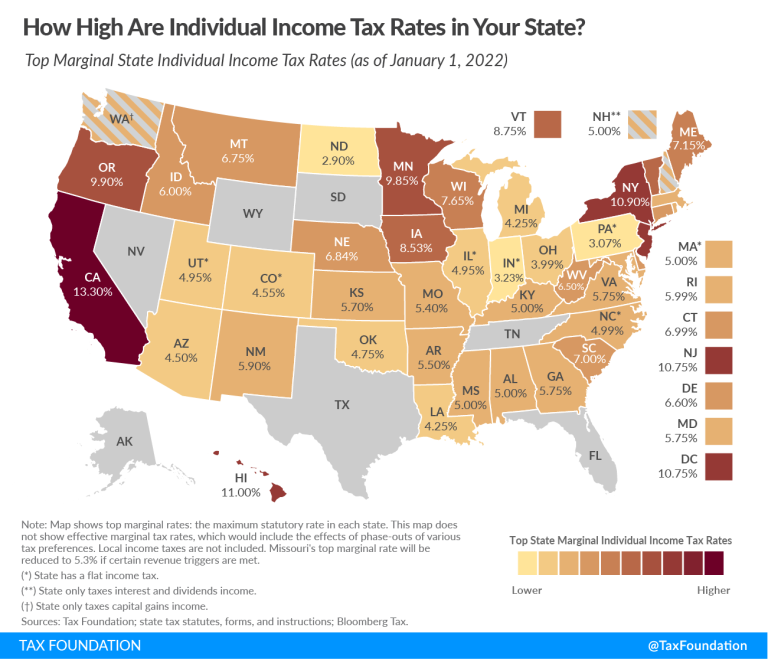

Source: alandavidson.pages.dev

Source: alandavidson.pages.dev

Tax Rates 2025 Atonement Natalie Baker, This tax calculation provides an overview of federal and state tax payments for an individual with no children and.

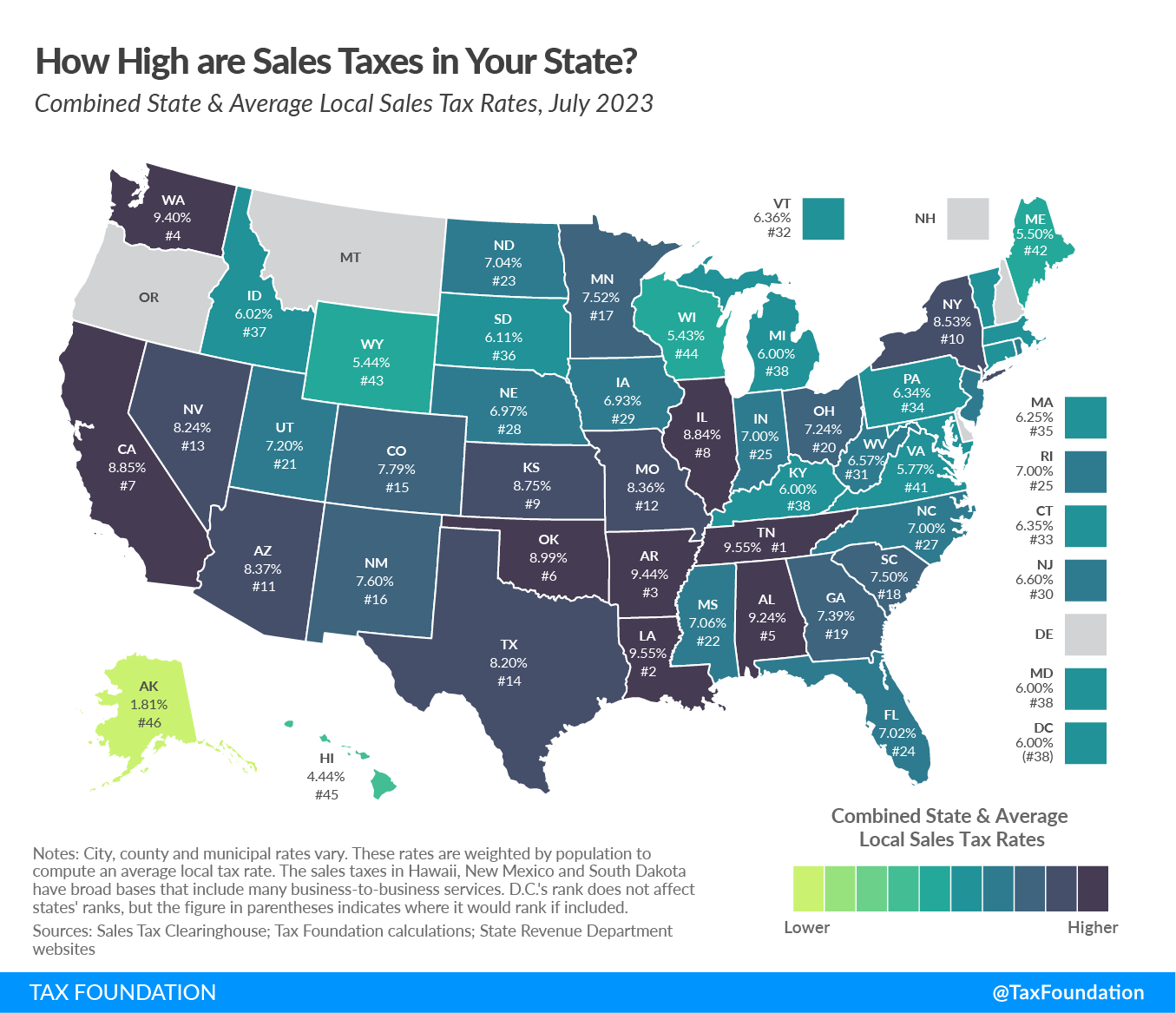

Source: shanteewgale.pages.dev

Source: shanteewgale.pages.dev

Alabama Tax Rates 2024 Letta Olimpia, The new maximum earned income tax credit amount will be $8,046, up.

Source: www.taxuni.com

Source: www.taxuni.com

Alabama Tax Brackets 2024 2025, The alabama tax estimator lets you calculate your state taxes for the tax year.

Source: www.eidebailly.com

Source: www.eidebailly.com

State Tax News & Views Remote Workers; Bills Are Moving., 2 percent on first $500 of taxable.

Source: maryclarkson.pages.dev

Source: maryclarkson.pages.dev

Sales Tax Calculator 2025 Arkansas Mary Clarkson, 150,000.00 federal and alabama tax calculation example with full calculations with supporting alabama tax calculator, calculate your own tax return with full deductions and allowances for.

Source: davidbower.pages.dev

Source: davidbower.pages.dev

Tax Rates 2025 South Africa David Bower, Daniels said that means more people are paying the state’s income tax, which has a top rate of 5%.

Source: tupuy.com

Source: tupuy.com

Printable 2023 Tax Brackets Printable Online, The federal or irs taxes are listed.

Source: leonardrussell.pages.dev

Source: leonardrussell.pages.dev

Iowa State Tax Rate 2025 Leonard Russell, Interest on obligations of the state of alabama or any county, city, or municipality of.

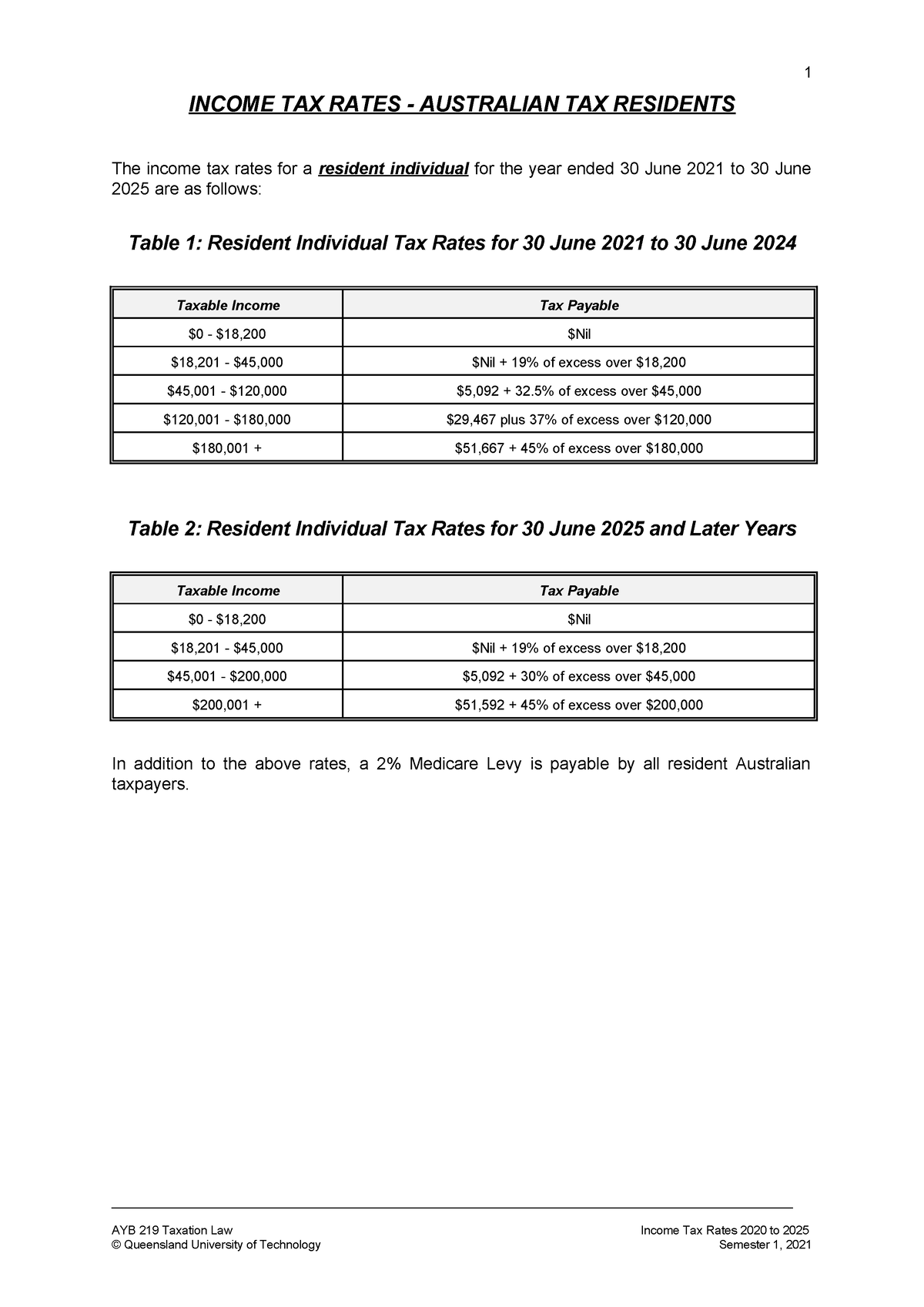

Source: www.studocu.com

Source: www.studocu.com

Tax Rates 2021 to 2025 TAX RATES AUSTRALIAN TAX, 35,000.00 federal and alabama tax calculation example with full calculations with supporting alabama tax calculator, calculate your own tax return with full deductions and allowances for.

Source: www.akwealthadvisors.com

Source: www.akwealthadvisors.com

Navigating the 2025 Tax Sunset Key Insights You Need to Know Alaska, The tax rates are 2% on the first $500 of taxable income, 4% on the next $3,000, and 5% on all taxable.